1. Executive Summary

After peaking above US$80,000/t in 2022, lithium carbonate prices have plummeted to current levels of around US$8,500/t, erasing nearly 90% of their value in less than two years. This correction has hit new and high-cost projects especially hard, many of which were planned during the lithium bull run.

The price collapse triggered a domino effect across the industry: suspended or indefinitely postponed projects, mass layoffs by major producers like Albemarle and SQM, temporary shutdowns in Australia, and widespread cuts in expansion spending.

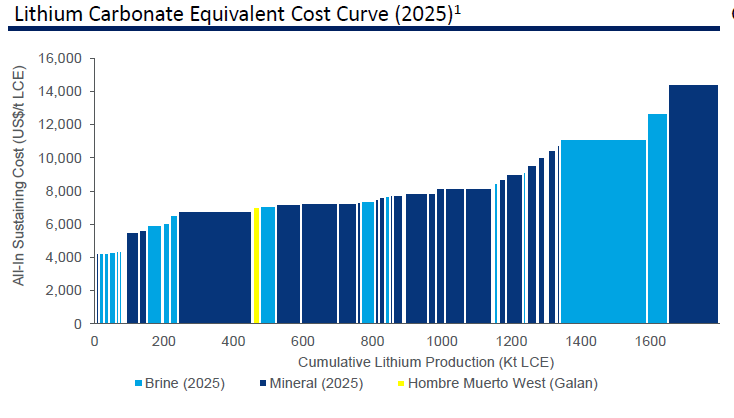

At today’s prices, a large portion of global supply operates on thin margins or even at a loss. Industry-wide average production costs are estimated between US$10,000 and US$12,000/t LCE, with significant differences depending on the type of operation. A substantial share of global output comes from spodumene — a more expensive lithium source due to energy-intensive processing — compared to brine projects, which are typically cheaper.

According to data gathered by Galan Lithium, many hard rock assets have total costs ranging from US$8,600 to US$14,700/t LCE, while brine projects like Hombre Muerto West (Argentina) can operate at costs as low as US$5,757/t LCE, placing them in the first quartile of the global cost curve. Thus, companies extracting lithium from brines, not spodumene, can remain profitable even in depressed price environments.

This positions Galan as a future low-cost producer with significant reserves and a current share price entirely disconnected from the company’s fundamentals — which is understandable given the deep cyclical trough we are in.

2. Location and Geology

Galan Lithium holds a world-class asset located in the Salar del Hombre Muerto in Argentina, right at the heart of the Lithium Triangle.

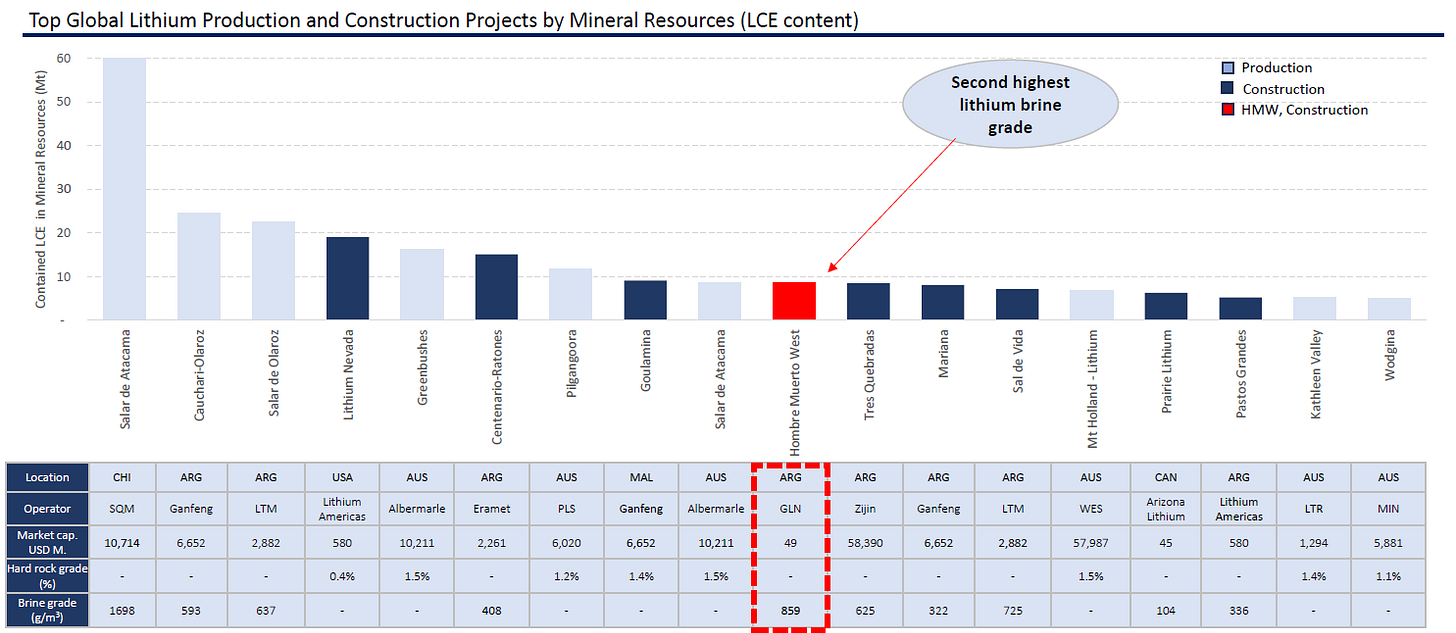

While most salars have grades below 250 ppm, Hombre Muerto boasts exceptionally high concentrations, reaching 850 ppm — one of the highest globally, according to S&P Global. This puts Galan’s asset among the Top 10 lithium resources worldwide.

The salar also stands out for its purity and exceptionally low production costs. According to Wood Mackenzie, the project’s total cost is estimated at just US$5,757/t LCE, making it the most competitive asset among ASX-listed peers and placing it firmly in the first cost quartile.

The key lies in its high-grade brine production, with lithium concentrations sufficient to produce a 6% lithium chloride concentrate — equivalent to 12.9% Li₂O or 31.9% LCE — double the concentration of most spodumene projects and in a more attractive chemical form for conversion into carbonate and battery-grade material. This product is ideal for LFP battery manufacturing, whose demand continues to rise, particularly in China, in contrast to nickel-rich NCM batteries, which are losing momentum due to lower efficiency.

Although Argentina has not historically been the most investor-friendly country, the new government under Javier Milei appears committed to revitalizing the mining sector.

3. Resources and Reserves

Galan holds an enormous resource base exceeding 9.5 Mt of LCE, which will allow it to remain in production for decades and scale up output if necessary. At Phase 2 levels (20 ktpa), this would provide over 40 years of production.

The resource is distributed between its two flagship projects: Hombre Muerto West (HMW) and Candelas, both located in the Hombre Muerto salar, one of the world’s richest regions for high-quality brine lithium extraction. According to the latest consolidated technical report:

• Hombre Muerto West (HMW): o Measured + Indicated resources: approx. 2.5 Mt LCE o Average grade: ~880 mg/L lithium o Low impurities (Mg/Li < 2), facilitating processing and reducing costs

• Candelas: o Indicated + Inferred resources: approx. 7.0 Mt LCE o Average grade: ~672 mg/L lithium o Also favorable chemical characteristics for direct LCE conversion

In total, this adds up to ~9.5 Mt of LCE with potential for expansion through further exploration, especially in undrilled areas of HMW North and southern Candelas. Galan owns 100% of both assets, meaning no revenue or resource sharing with partners — unlike many of its peers.

Although only HMW is currently advancing toward production, Candelas remains a key long-term asset and will likely be developed later.

4. Project Economics

The project’s first stage (Phase 1) targets an initial production of 5.4 ktpa of LCE, with first output and sales expected in H1 2026 — a likely trigger for a long-awaited re-rating. Galan already holds all necessary permits, has the nanofiltration plant under construction, and has stockpiled 9,500 t LCE equivalent in evaporation ponds. Crucially, funding and offtake agreements for this phase are secured, eliminating one of the main risks for junior developers.

From Phase 1, Galan plans to scale progressively in four stages up to 60 ktpa LCE:

• Phase 1: 5.4 ktpa LCE. Under construction. First sales expected H1 2026.

• Phase 2: 21 ktpa LCE. Construction permits granted.

• Phase 3: 40 ktpa LCE. DFS to follow Phase 2.

• Phase 4: 60 ktpa LCE. Will integrate Candelas resources and leverage HMW infrastructure.

This staged approach allows Galan to reduce financial and operational risk while gaining operational experience. The company will ramp up output as market conditions improve.

Assuming an AISC of US$7,000/t (above company estimates for a conservative buffer) and a price of US$12,000 for 2028–2029, Phase 2 alone could generate over US$100M in pre-tax cash flow annually.

As CEO JP Vargas de la Vega stated:

“At these price levels, we’re still making money. Hombre Muerto West is just a different kind of project. Low cost, no debt, and aligned with future demand.”

The management team’s confidence in the project was further demonstrated in May 2025, when a consortium led by Renault and a global trading firm attempted to acquire Galan for US$150M. The board swiftly rejected the offer, viewing it as well below the asset’s true value. Ironically, Galan’s market cap hovers around US$100M, highlighting the disconnect between strategic value and current market pricing.

The NPV of Phase 2 was previously estimated at US$2 billion based on a lithium price of US$18,000/t. While that scenario is optimistic, it's not unrealistic as a long-term average, given the cost structure of many spodumene-based producers.

Lithium chloride: a Future-proof product

One of Galan’s smartest strategic decisions has been to focus on lithium chloride (LiCl) rather than carbonate or hydroxide. While less common in Western markets, LiCl offers clear advantages amid a technology shift in the battery sector.

With LFP batteries now dominating the Chinese EV market and gaining ground globally — used by Tesla, BYD, and others — LiCl has become increasingly relevant. Unlike hydroxide (used in NCM batteries), LiCl can be converted into lithium carbonate or phosphate more efficiently, with lower costs and a smaller environmental footprint.

This reduces downstream costs and eliminates the need for expensive on-site conversion plants. Galan has avoided both direct lithium extraction (DLE) and carbonate production infrastructure, reducing initial capex and technical risk. Its strategy is to sell high-purity LiCl concentrate, with higher lithium content than spodumene-based alternatives.

Galan has already secured offtake agreements that strengthen project economics. In April 2025, it signed a binding deal with Authium Limited for up to 45,000 tonnes of LCE over 6–12 years, including a US$6M prepayment. Additionally, a MoU with Chengdu Chemphys covers 23,000 tonnes of LCE in the first five years and a potential US$40M prepayment, pending final agreement. These deals support Galan’s commercial viability and validate its product strategy.

5. Management and Corporate

Structure Galan Lithium is led by a lean but capable team with relevant experience in lithium development and a strong execution focus. CEO and founder Juan Pablo Vargas de la Vega has played a central role in acquiring the Hombre Muerto assets and designing the phased development plan.

Board members include strategic profiles like Daniel Jiménez, a former SQM executive with deep market knowledge, and others with exploration, engineering, and finance experience across Latin America.

Management holds around 3% of the company’s shares — below ideal alignment levels, but still material. Long-term shareholders and natural resources-focused institutions (mostly Australian and European) hold additional stakes. However, a majority of shares remain in the hands of retail investors, which is not ideal for long-term stability.

Galan has about 945 million shares outstanding, with another 100 million in options, implying potential 10% dilution if exercised. This capital structure is typical for juniors operating in a low-cycle environment, where limited equity value requires large share issuance to fund development. On the positive side, Galan has no industrial partners or royalties, giving it full strategic flexibility.

6. Upcoming Catalysts

After years of dilution, price collapse, and project development, Galan is finally about to enter cash-flow territory. With first production and sales expected in H1 2026, the company is poised to shift from promise to delivery as a low-cost lithium producer.

The price collapse driven by oversupply is already forcing many projects to close or pause, while demand continues to surge. Inventories are expected to normalize soon, lifting prices and boosting sentiment across the sector.

This transition to production, combined with improving lithium prices, could be the catalyst for a significant share price re-rating.

7. Risks

Despite a large resource base and favorable location, Galan faces several key risks.

First, financing risk remains. Phase 2 of Hombre Muerto West requires US$278M in CAPEX (DFS Phase 2). While some offtake deals are in place, Galan has not yet closed full funding. This raises the possibility of significant dilution unless the company can fund expansion through cash flow or debt.

There is also operational risk from reliance on solar evaporation technology, which, though common in the region, depends on stable weather and long evaporation times. Climate variability or technical challenges could affect recovery efficiency.

Like all in this sector, Galan is exposed to lithium price volatility. A prolonged downturn or recession could impact expansion viability and dampen offtaker interest.

Lastly, geopolitical and regulatory risk in Argentina remains. While Catamarca province has been mining-friendly, national-level policy shifts could affect import controls, capital repatriation, or taxation — as seen in the past. That said, the new government’s pro-mining stance could reduce these risks going forward.

In short, Galan remains high-risk, but those risks are declining as it moves into production. Long-term profitability will depend on successful execution and reaching Phase 2.

8. Valuation and Conclusion

Despite the market headwinds, Galan Lithium presents a compelling value proposition. Hombre Muerto West is one of the richest lithium salars globally, supported by large resources and a low-risk development model.

Economically, it stands out with an estimated total production cost of just US$5,750/t LCE — sufficient to generate healthy margins even at depressed prices around US$8,500/t.

With expected production of 4 kt LCE in 2026 and 5.4 kt in 2027, Galan could generate US$20M in 2026 and US$30M in 2027 at US$12,000/t prices. Under Phase 2 (21 ktpa), it could earn US$100–130M in annual EBITDA, even with conservative pricing. With capex already partially deployed, payback could be fast.

Previous presentations estimated an NPV of over US$2 billion under more optimistic scenarios. Even with adjusted prices, the value remains substantial, especially when compared to Galan’s sub-US$100M market cap. In a slightly improved market, Galan could generate US$250M/year, aligning with DFS projections.

In short: the built assets, reserves, and cost position far exceed the valuation currently assigned by the market — and you can still buy shares for a third less than what Renault was willing to pay.

9. References and Resources

· Official website: https://galanlithium.com.au/

· Note: I currently hold shares in the company. This is not a buy recommendation.