Some of my favorite investment stories are junior miners that are either transitioning into production or already producing but planning to scale up significantly. In the microcap sector, few people read the reports, and most don’t look beyond what's already being talked about or what's been achieved. That’s why these production growth stories often go unnoticed by those who don’t stop to examine every stone along the way. While exploration-focused juniors see their revaluations when they expand resources, producers get re-rated when they increase output. In today's case, we might have both. Let’s analyze Silver X Mining, a producer with ambitious growth plans and a massive land package still largely unexplored. So there are two potential sources of upside here.

1.Summary

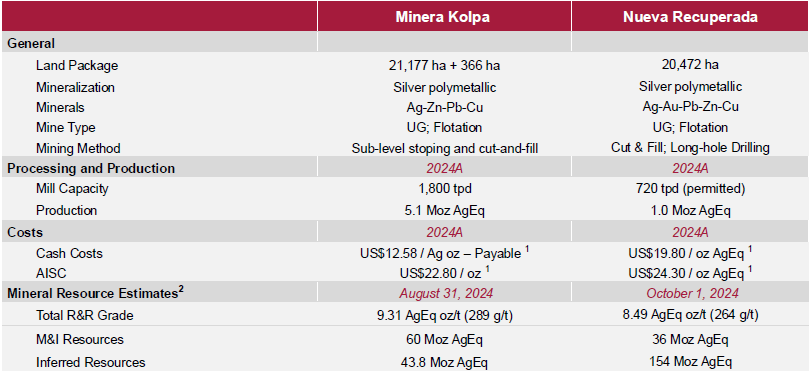

This silver junior (AGX:TSXV) is located in the heart of the polymetallic belt of Huancavelica, Peru. Through its underground mine Nueva Recuperada, the company produces silver, lead, and zinc, and already operates a processing plant, with a second mine expected to come online by 2026. Unlike many juniors focused solely on exploration or future promises, Silver X is already generating ounces today and executing a clear expansion strategy.

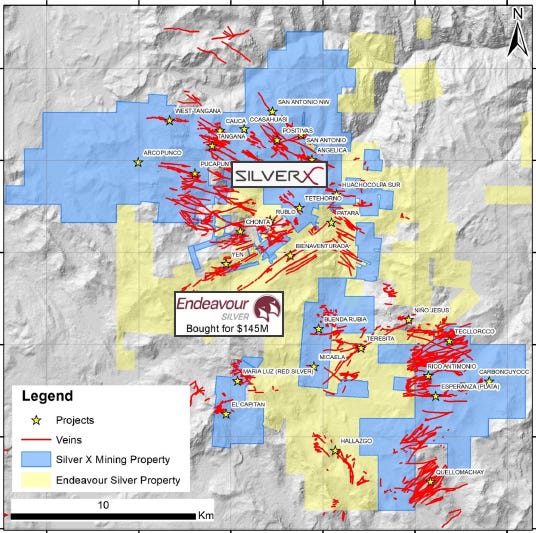

The company controls over 20,000 hectares of contiguous land, positioning it as one of the largest landholders among juniors in the country, with the potential to develop a true mining district. Within this area, dozens of mineralized veins have been identified, many still undrilled and not included in official resource estimates. Their current focus combines increasing production, developing new zones (such as Tangana Deep, Plata and Morlupo), and selective exploration in high-grade targets.

Despite this operational reality, Silver X trades at a market cap below CAD 75 million, which highlights a clear disconnect between its market valuation and the economic potential of its assets. The combination of growing production, installed infrastructure, open resources, and a disciplined growth strategy makes Silver X an asymmetric opportunity with moderate risk and massive upside.

2.Location and Geology

Peru is one of the most important mining countries in the world. It's the second-largest global producer of copper and silver, and among the top producers of zinc, lead, tin, and gold. The mining sector represents about 10% of GDP and over 60% of total exports. There’s a well-established mining culture, infrastructure, contractors, and technical talent, allowing companies to operate at relatively low costs compared to other countries.

Despite recurring political instability, the mining industry continues to function. Many major projects have progressed even in tough years, and operations in traditional zones like Cajamarca or Huancavelica remain active. In terms of exploration and development, Peru remains an attractive destination due to its geological potential, known legal framework, and installed capacity. They haven't killed the goose that lays the golden eggs.

Operating in Peru comes with risks, but they are significantly lower than in other jurisdictions, while offering access to infrastructure and technical expertise.

Silver X's flagship project is Nueva Recuperada, where it currently operates the underground Tangana mine and a 350 tpd processing plant (expandable to 720 tpd). The entire operation is located at over 4,400 meters above sea level, within a continuous land package of 20,472 hectares—a notably large area for a junior and even uncommon among producers.

This property hosts a low-sulfidation epithermal system with over 500 identified veins and splays, grouped into more than 200 geological targets. Most remain systematically unexplored.

The veins are hosted in andesitic volcanic rocks, with well-defined geometry and a dominant northeast-southwest orientation. Structural control is clear: mineralization follows consistent fracture zones, which facilitates modeling and underground development. These structures show strong lateral and vertical continuity, and several veins extend beyond the current resource model.

At depth, the system improves. Higher-grade mineralization has been identified below 4,460 masl, particularly in Tangana Deep, reinforcing vertical growth potential. Besides Tangana, areas like Plata, Morlupo, Caudalosa, Cacasahuasi, and San Antonio remain in early stages and offer additional exploration upside.

Silver X is also consolidating land surrounding Endeavour Silver’s property, and some veins mapped by Endeavour cross over into AGX’s block, suggesting continuity on a district scale. That property was acquired in May this year for $145 million. Despite Endeavour having invested more money, their resource size is nearly half of Silver X’s, once again highlighting the disconnect between value and market cap.

3.Resources and Reserves

Silver X’s resource growth is a success story. In their latest update, they increased Inferred resources by 45% and Measured & Indicated by 18%. This success stems not just from smart drilling but also from the sheer potential of the property, with over 200 targets still to be drilled.

There are precedents. Projects like Kuya Silver’s Bethania began with just a few veins and significantly expanded their resource base through structural mapping and systematic sampling, without needing massive drilling upfront. Silver X is in a similar position, but with much more infrastructure already in place.

With nearly 200 million silver equivalent ounces, this miner could significantly increase and sustain production over time. And that's with only a small portion of the property explored. Given the dense vein system, the company plans to implement a hub-and-spoke model, where different mines—Tangana, Plata, Morlupo, etc.—(the "spokes") feed a central processing hub at Nueva Recuperada. This allows scalable production without duplicating infrastructure, leveraging a single plant for multiple underground sources.

4.Project Economics

Silver X is one of the few juniors that already generates ounces and cash flow, albeit still at a small scale and not yet profitable. In Q1 2025, they processed around 40,000 tonnes, producing 240,248 silver equivalent ounces. Currently, silver accounts for only 25% of revenue, but that should shift as they access higher-grade silver veins. For instance, Red Silver (not yet in production) has grades of 500 g/t.

Quarterly revenue was $5.9M, with positive EBITDA but no net profit. AISC remains high, but the company expects it to drop as production scales. The CEO has stated that long-term AISC is targeted at $20–22/oz—not the lowest, but still competitive. With a realized silver price of just $24 in Q1, future results could improve if silver keeps rising.

The upside lies in increasing throughput and ore grade, especially if zones like Tangana Deep or Plata Oeste come online. The current plant is nominally rated for 350 tpd but has been operating above that level and is enabled for up to 720 tpd. The company is also planning to expand capacity even further. Their development plan includes building a new plant at Tangana (1,500 tpd), expanding the current plant, new dry-stack tailings facilities, and additional mine development. The total budget for this full expansion is $61 million, including 20% contingency.

If Silver X achieves its target of 6 Moz by 2028, the stock’s potential upside is enormous. Even assuming they don’t drastically lower AISC, if silver stays strong, annual cash flow could far exceed the company’s current market cap. A rough, conservative estimate: at $38 silver, with 4 Moz production and $24 AISC, they could be generating $60–70M in pre-tax cash flow annually. That’s well above today’s ~$52M market cap.

More volume and better grades should reduce cost per tonne, improving margins. And with silver prices rising, AGX’s operating leverage could be significant: they have the plant, they have the veins, they just need more tonnage.

5.Team and Shareholders

Silver X is led by a technically focused team, headed by CEO José M. García, who has experience developing underground mines in Peru. The board includes names like Darryl Cardey and Francis Johnstone. While the company doesn’t disclose deep bios, it’s clear they’ve chosen people familiar with both the geology and the operating environment in Peru.

As of Q1 2025, the company had 222.5 million shares outstanding, along with 46.3 million warrants, 6.6 million options, and 450,000 RSUs. There are also 1.2 million broker warrants and convertible notes issued through recent financing. While that may sound like a lot, the total share count is still quite restrained compared to other juniors that have issued billions of shares without producing an ounce.

Regarding ownership, insiders hold about 6% of the company, institutions another 9%, and the rest—around 85%—is free float (though some of that is in strong hands). Strategic shareholders include Triple Flag, which holds a 3% NSR royalty over the Tangana unit, and Trafigura, which financed the company via a secured loan and received 1.5 million warrants. This ownership mix, with institutional and industrial partners plus aligned management, results in a shareholder base that’s not overly tight, but not loose either.

6.Near-Term Catalysts

The most immediate catalyst is the Q2 2025 earnings release, scheduled for August 26. Silver X already surprised the market in Q1 with positive EBITDA, and if it can repeat or improve, attention could ramp up quickly. If they've managed to increase throughput and grade over the past three months, we could even see net profits—and that would just be the beginning. Two profitable quarters in a row would mark a clear shift.

The second big catalyst is the 8,000-meter drill campaign at Tangana, now underway after 2,300 meters of underground development. First results could be released any time. If they show continuity or high grades, that could support a resource update and strengthen the growth story.

Finally, there’s the expansion plan: going from the current 350–720 tpd up to 1,000 or even 1,500 tpd. The company is already updating its EIA and has advanced social agreements. If they secure funding or break ground, that would mark another milestone in their transformation from a small junior to a consolidated producer.

That financing need brings us to the next point.

7.Risks

Silver X’s balance sheet isn’t the strongest: working capital at the end of Q1 2025 was -$14M, showing liquidity pressure and ongoing funding needs. The company has managed this via a mix of structured debt, strategic partnerships, and equity issuances.

Since March 31, Silver X has secured two new funding lines. First, a $1.4M loan from Trafigura (25 months, SOFR +6%), with 1.5M warrants attached. Second, an additional $2M prepayment facility, also from Trafigura, tied to a copper concentrate offtake contract and 2.5M additional warrants. The company also completed a CAD 3.5M private placement on April 5 (post-Q1), not yet reflected in financials but likely to improve the Q2 cash position.

Despite these moves, more equity issuance can’t be ruled out if major investments are needed or if cash flow doesn’t improve. It all depends on Q2 results: if profitability continues, dilution may be avoided. If not, another capital raise may be on the table.

8.Valuation

We’re not looking at a perfect miner here—but then again, which one is? The balance sheet is weak, production is still modest, and they earn more from lead and zinc than silver for now. But the growth narrative is clear and actionable, and even factoring in dilution, if Silver X hits its targets and silver performs, this company could be printing money.

With a clear path toward 6 Moz Ag Eq by 2028, plant expansion underway, and new high-grade zones being developed, the upside is massive. Even assuming just 4 Moz by 2028, $40 silver, and a $24 AISC, they could be generating $60M+ in pre-tax cash flow annually—well above the current $52M market cap. In other words: this is a potential multi-bagger. And as we know, 10x or 20x gains in juniors during bull cycles aren’t uncommon.

In a sector full of explorers going nowhere, Silver X already has a working plant, known veins, signed social agreements, and an operating mine. The challenge now is execution and funding that next phase without excessive dilution. If they get it right, this could be one of the standout silver growth stories in South America.

And if silver takes off, as many expect, there may come a time when valuation won’t even matter—anything with "Silver" in the name will fly. And we know that’s happened before.