1. General Summary

Talisker Resources is a Canadian junior mining company listed on the TSX under the ticker TSK. Its flagship project is located in British Columbia and is focused on gold extraction. The company is currently in a transitional phase between exploration and production—a critical stage that presents significant opportunities for those willing to take on some risk.

In a market where gold prices are at all-time highs, Talisker stands out as an attractive opportunity due to its low market cap (~60 MUSD), a project with a proven historical track record and high-grade mineralization, and a development strategy that minimizes upfront capital requirements. The current resource stands at 1.7 million ounces of gold (inferred), but the company aims to grow that figure to 5 million through future drilling campaigns. If it executes its plan successfully, Talisker could become one of the most compelling gold stories in Canada in the coming years.

At these figures, investors are effectively buying gold ounces at around $35 each, while the project could be valued at over $1 billion.

2. Location and Geology

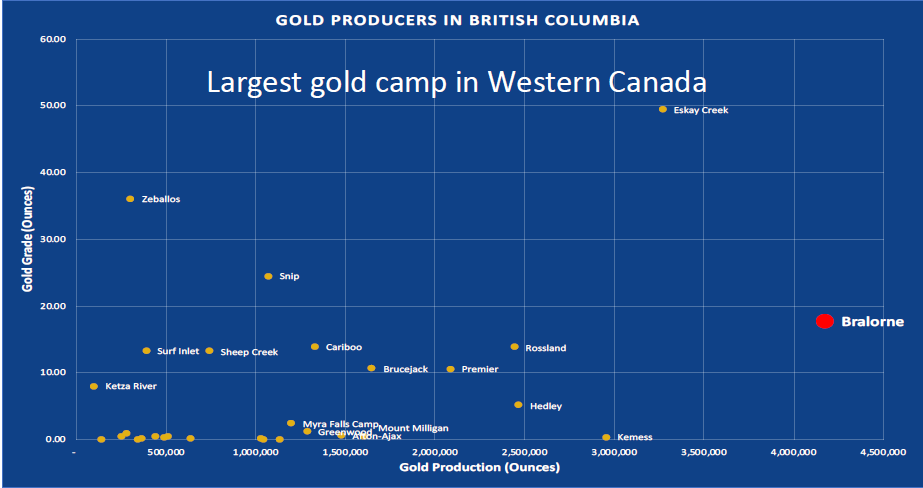

Talisker’s main asset is located in the historic Bralorne gold district in British Columbia. This district was one of the most prolific in Canada, with total production of over 4 million ounces at an average grade of 17.7 grams per tonne before mining ceased in 1971 due to low gold prices. Had they held on a bit longer, they would have seen gold prices skyrocket tenfold over the next decade (thanks to Nixon and Bretton Woods), and this story might never have needed to be told.

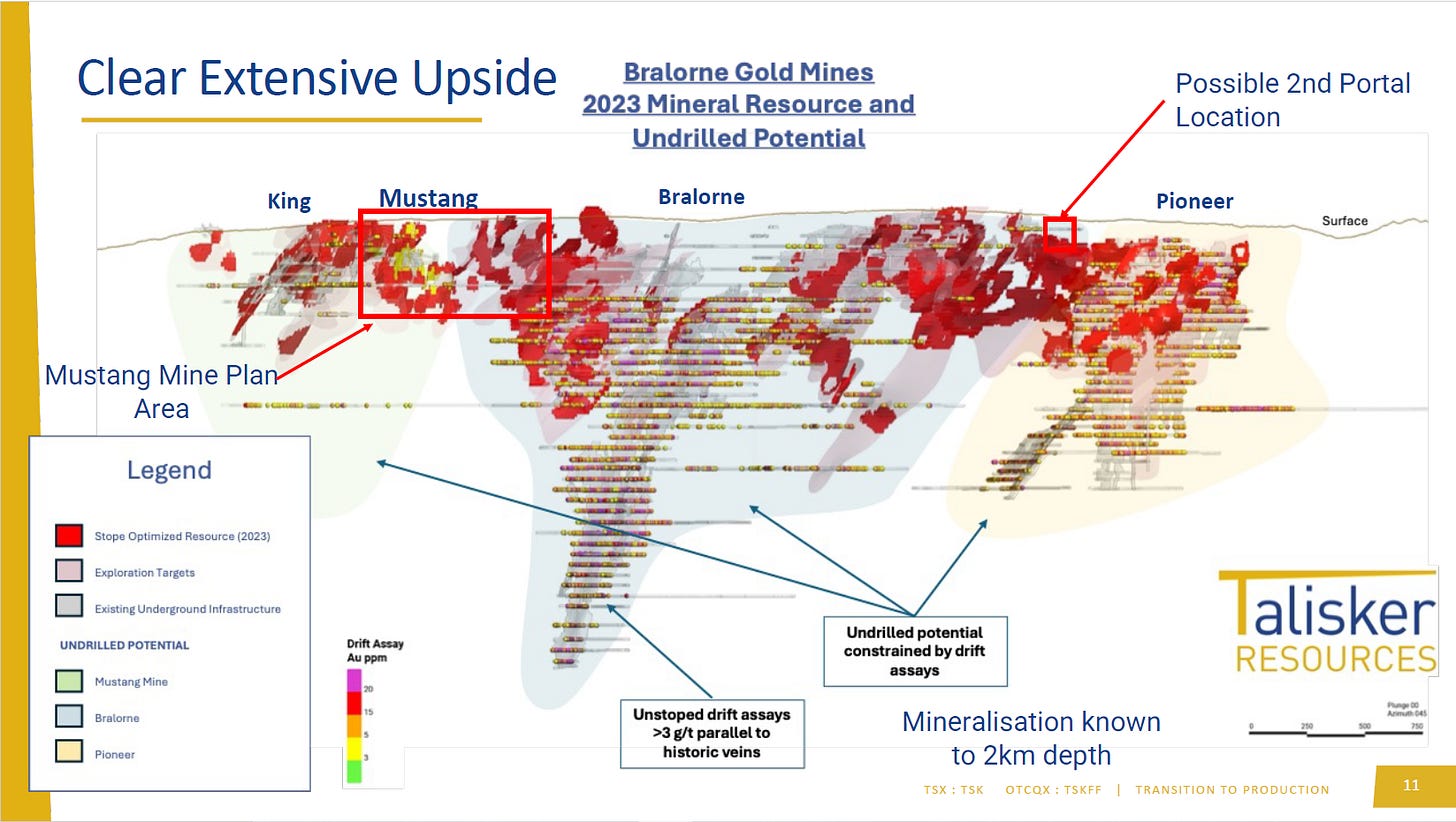

The project was acquired by Talisker in 2019 from Avino Silver & Gold and has since undergone intensive redevelopment. Within the complex, 63 veins have been identified, of which only 30 were historically mined to a depth of 900 meters. Importantly, many of these veins remain open at depth, with mineralization evident to at least 1,500 meters. While the full extent is not yet quantified, the signs are promising.

The location also benefits from excellent logistics: road access, nearby hydropower (a plant just 4 km away), and processing facilities hungry for feedstock—all of which allow Talisker to consider a toll milling model and avoid the cost of building its own plant.

3. Resources and Reserves

Talisker currently holds 1.7 million ounces in inferred resources, the lowest-confidence category in mining classification standards. While this is already a substantial figure, the company has stated its goal is to reach at least 5 million ounces through further drilling. Time will tell how successful they are.

To date, no formal technical studies like a PEA (Preliminary Economic Assessment) or PFS (Pre-Feasibility Study) have been published, which adds uncertainty—but also significant revaluation potential if economic viability is confirmed.

This is where the project's main risk lies. While drilling results and gold grades appear promising, there is no certainty yet. Any variation in grade per tonne could significantly affect project economics.

Despite the lack of proven or probable reserves, the geology of the district, the historical high grade, and vein continuity suggest significant upside potential. If expectations are met, this could become a Tier-1 operation.

4. Project Economics

One of the most appealing aspects of Talisker’s plan is its low-capital model. The company aims to begin production without building its own processing facility by toll milling at nearby plants (already signed with Nikola Mining) and subcontracting mining operations to the Thyssen Group. This greatly reduces the required CAPEX and accelerates time to production.

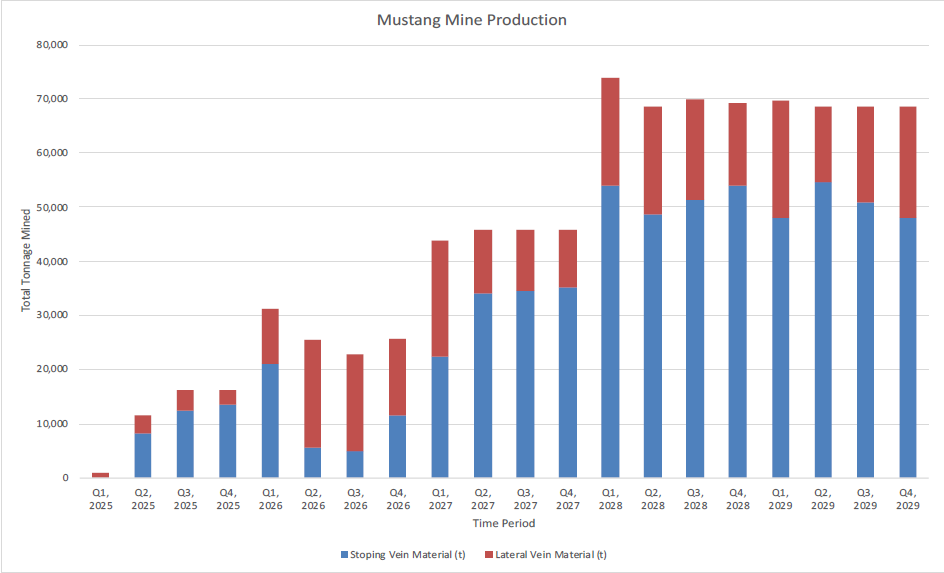

Production targets are ambitious but staggered. In 2025, they aim to start with 100 tonnes per day, then scale to 150, eventually reaching 10,000–20,000 ounces in 2026 and full production of 750 tonnes per day by 2028, equivalent to around 100,000 ounces per year.

Initially, ore will be extracted from the Mustang zone, but once resources expand, Talisker envisions a "hub and spoke" model where multiple small mines feed a central plant.

Talisker estimates an AISC (All-In Sustaining Cost) of around $1,500/oz, compared to a gold price of $3,400/oz. This would yield an attractive $1,900/oz margin.

For reference, producing 20,000 ounces in 2026 would generate about $38 million in pre-tax free cash flow—nearly equivalent to the company’s entire current market cap. By 2028, full production could deliver $120 million annually. At $3,400 gold, project NPV could reach $1 billion, and potentially $1.3 billion if gold rises to $4,000.

If Talisker succeeds in growing its resources to 5 Moz, it could target production of 200–250 koz annually, generating $300–500 million in free cash flow. This would position the project as a world-class Tier-1 mine with excellent grade and massive reserves, pushing its NPV towards $2.5 billion.

5. Management and Capital Structure

CEO Terry Harbort is a geologist with extensive experience in gold projects and has led Talisker since acquiring Bralorne. His approach is technically driven and focused on disciplined exploration and value creation. In several interviews, he comes across as knowledgeable and patient—he’s stated this will be his last major project, so he’s highly motivated to make it a success.

Due to limited access to capital in recent years, the company has relied on equity issuance, leading to significant dilution. Nonetheless, Talisker maintains a clean balance sheet with no material debt and has been transparent about its growth strategy and funding needs.

Key shareholders include well-known names like Sprott, NewGold (which holds 10%), and Templeton. Insiders own 6.4% of shares—not a controlling stake, but enough to align interests. Overall, only 46% of shares are in retail hands.

6. Upcoming Catalysts

In the short and medium term, Talisker has several catalysts that could drive its share price. The most immediate is the start of production, which is likely underway as this is being written. The company plans to gradually scale up throughput and annual output through 2028. If successful, the market is unlikely to ignore it for much longer.

Another key milestone would be the release of a PEA, offering a clearer view of expected project economics. Additionally, drilling results aimed at increasing resources to 5 Moz will be closely watched.

All this is happening in a favorable gold price environment, which could boost investor enthusiasm if Talisker delivers on execution.

7. Risks

Like any early-stage development company, Talisker faces multiple risks. The most significant is geological: with only inferred resources, there is limited certainty about vein continuity and grade. If the veins prove shorter or lower-grade than expected, profitability could take a hit.

Financially, although the asset-light strategy reduces CAPEX needs, further equity raises may still be required to fund operations and growth—bringing potential for dilution. That said, positive cash flow should limit future equity needs.

There is also technical execution risk, as the project has not yet gone through all formal economic studies. Lastly, gold price volatility remains a key external factor: a sharp decline could materially impact future revenues.

8. Valuation and Conclusion

Talisker Resources presents an asymmetric risk-reward profile. Its tiny market cap (~50–60 MUSD) is dwarfed by the potential of a project that could generate significant cash flow if it hits its 100,000-ounce annual target by 2028. With an estimated NPV of $1–1.5 billion, revaluation potential is substantial.

Operating in a safe jurisdiction with solid infrastructure and pursuing a phased, low-capex development path, the company’s thesis appears well grounded. Still, geological and financial risks remain meaningful.

In conclusion, Talisker could become a textbook re-rating story: from cash-burning explorer to cash-generating producer. For investors with a 1–3 year horizon and appetite for volatility, it may offer a compelling opportunity.

9. References and Resources

Official website: https://www.taliskerresources.com/

Presentation and visuals:

https://www.taliskerresources.com/investors/presentation/

Disclaimer: I currently hold shares in the company. Not financial advice.